With its secure private transactions carried out on the blockchain, crypto escrow plays a crucial role in making online transactions safe and reliable. Understanding how crypto escrow works and why use it can help buyers and sellers feel safe while trusting the process more. This guide explains how crypto escrow works and compares it to traditional escrow alternatives.

The goal is to help cryptocurrency users understand the mechanism behind blockchain escrow services to make online transactions more transparent and secure for everyone involved.

Table of Contents

How Crypto Escrow Works

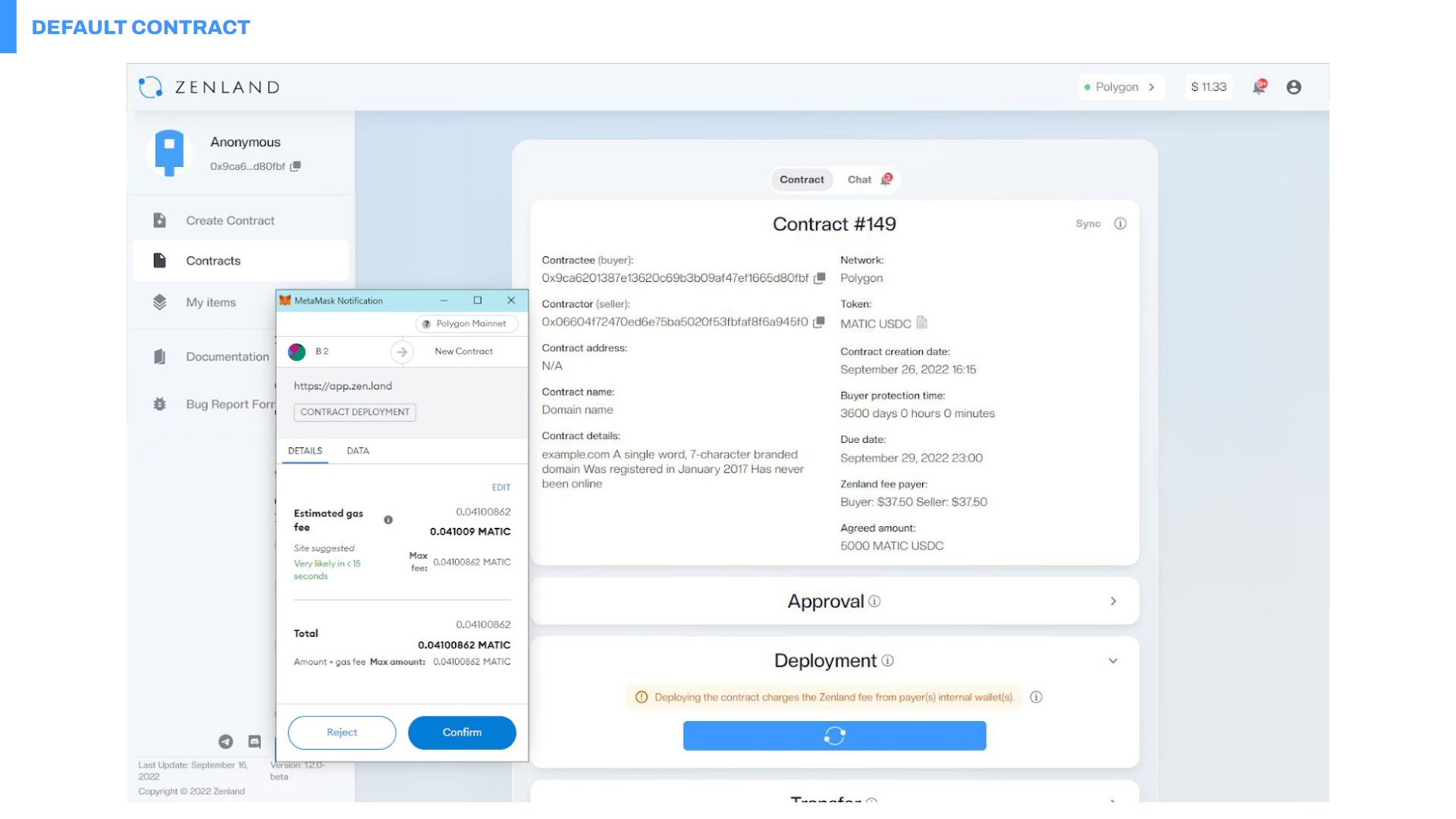

Smart contracts are the backbones of any escrow built on the Ethereum blockchain. They act as smart lockers for any private transaction between the buyer and the seller. Rather than relying on a third party, as in a traditional escrow, the rules of the escrow agreement in crypto escrow like Zenland are written directly into a smart contract code.

That said, every participant plays an important role in a crypto escrow transaction. The buyer starts by putting their cryptocurrency into escrow. The seller waits for confirmation that the cryptocurrency is in escrow before delivering what they promised. The escrow service acts like a fair judge, holding onto the cryptocurrency until both sides agree that everything is done right. This way, transactions can happen safely even between people who don’t know each other well.

Here is how the process of crypto escrow on blockchains like Ethereum works:

- Agree on the transaction

The buyer and seller agree on the terms of the transaction, which are encoded into a smart contract. This includes details such as the goods or services exchanged, the price, and any conditions to be fulfilled for the transaction to be completed. - Initiate the escrow

The buyer initiates the escrow process by sending the payment in cryptocurrency tokens into the smart contract. This action signals the start of the escrow agreement. - Verify terms completion

The smart contract verifies whether all predefined conditions of the transaction are met. These conditions can be automatically verified through predefined rules in the smart contract code. For example, conditions might include delivery confirmation or verification of a digital asset transfer. - Confirm the delivery

Once the seller completes the delivery of goods or services as agreed upon, they notify the smart contract. This notification can be in the form of confirming a shipment, providing a digital signature, or any other method the buyer and seller agreed to in the contract terms. - Release funds

Upon verification that all conditions are met (such as delivery confirmation), the smart contract releases the cryptocurrency payment held in escrow to the seller. This release eliminates the need for a human intermediary and ensures that funds are transferred only when agreed conditions are met. - If needed, dispute

Smart contracts can also include mechanisms for dispute resolution. For instance, they may include options for arbitration or predetermined conditions under which funds are returned to the buyer if disputes arise and both parties struggle to resolve the issue. - Keep a record of escrow transactions

The transaction is completed as the smart contract executes and the funds are released to the seller. The entire process, including the agreement, fund transfer, and conditions fulfillment, is recorded on the blockchain. This transparency ensures that all parties can verify the transaction details, enhancing trust and reducing the risk of fraud.

This crypto escrow process illustrates how Ethereum smart contracts leverage the security and immutability of blockchain technology to create a trustless environment where transactions can be executed reliably between parties, even without prior trust or central authority.

To learn more about Zenland and its service visit our previous post about using Zenland crypto escrow.

Why Use Crypto Escrow?

To better understand how crypto escrow differs from the traditional one, let’s look at the four major areas of comparison for any new and existing technology: autonomy and automation, speed and efficiency, cost and accessibility, transparency and security.

- Autonomy and Automation

- Transactions in traditional escrow require manual intervention by the escrow service to verify conditions and release funds. This process relies on the trustworthiness of the escrow service to execute transactions fairly and securely.

- In crypto escrow, smart contracts add autonomy to the escrow process. Once the conditions specified in the escrow contract are met (e.g., delivery confirmation), the contract releases funds to the seller. This reduces reliance on human intervention, enhances transaction speed, and ensures that the transaction terms are enforced objectively and transparently.

- Transactions in traditional escrow require manual intervention by the escrow service to verify conditions and release funds. This process relies on the trustworthiness of the escrow service to execute transactions fairly and securely.

- Speed and Efficiency

- Traditional escrow processes can be slower due to the need for manual verification and processing by the escrow service. Transactions may take days to complete, especially in cross-border scenarios.

- Smart contracts operate in real time on blockchain networks. They enable faster transactions since the verification and execution of terms occur instantly once conditions are met. This speed is particularly advantageous for global transactions and time-sensitive transactions.

- Costs and Accessibility

- Traditional escrow services often involve fees paid to the escrow provider for their services. These fees can vary based on the transaction amount and complexity.

- Smart contracts can potentially reduce costs associated with escrow services. They replace brokers making transactions more cost-effective, especially for smaller transactions or transactions across borders.

- Traditional escrow services often involve fees paid to the escrow provider for their services. These fees can vary based on the transaction amount and complexity.

- Transparency and Security

- Because traditional escrow is centralized, trust in such services relies on the reputation and regulatory compliance of the escrow provider. While reputable providers offer security measures, the transparency of transaction details may vary.

- Transactions executed via smart contracts are recorded on the blockchain, providing an immutable and transparent history of activities. This transparency enhances security by allowing all parties to verify transaction details and ensures it is conducted as agreed upon without manipulation or deceit.

- Because traditional escrow is centralized, trust in such services relies on the reputation and regulatory compliance of the escrow provider. While reputable providers offer security measures, the transparency of transaction details may vary.

That said, the major difference between a cryptocurrency escrow and its traditional alternatives lies in ways they operate. In traditional escrow services, a central, trusted third party (such as a bank or escrow company) acts as a middleman between the buyer and seller. This centralization means that both parties rely on the escrow service to hold funds and enforce the initially agreed terms of the transaction.

On the other hand, a smart contract escrow operates on decentralized blockchain platforms. Here, the escrow function is automated through code (smart contract) deployed on the blockchain. The code enforces the terms of the agreement and holds funds in escrow, eliminating the need for a central authority to mediate the transaction.

Conclusion

Cryptocurrency escrow, using blockchain technology, ensures safe and private online transactions through mutual terms written into code logic. It works through smart contracts on platforms like Ethereum, automating the process without the need for a human intermediary. Buyers send cryptocurrency into a smart contract, which verifies conditions like item delivery. Once confirmed, the money is sent to the seller and the contract is closed. In contrast to traditional escrow services, this modern escrow method makes transactions quicker, less expensive, and more secure, keeping all purchase details on the blockchain for transparency and data security.